Profit percentage formula

Lets understand the application of these formulae with the following simple example. Gross profit percentage formula Total sales Cost of goods sold Total sales 100.

Profit And Loss Cbse Rs Aggarwal Class 7 Maths Solutions Exercise 11a Maths Solutions Math Solutions

Gross Profit 65000 - 60000.

. Gross Profit Margin Formula Net Sales-Cost of Raw Materials Net Sales Gross Profit Margin 100000- 35000 100000 Gross Profit Margin 65 Mrs. Say a company earned 5000000 in revenue by selling shoes and the shoes created 2000000 of labor and materials costs to produce. Profit Percentage 525 100 20.

X Net sales - Y COGS Z. Gross profit Revenue - Cost of goods sold. The ratio of profit percentage of A B.

Once the profit is calculated we can also derive the percentage profit e have gained in any business by the formula given here. The profit formula is stated as a percentage where all expenses are first subtracted from sales and the result is divided by sales. Profit or Gain Selling Price Cost Price.

It is the percentage of selling price that is turned into profit whereas profit percentage or markup is the percentage of cost price that one gets as profit on top of cost priceWhile selling something one should know what percentage of profit one will get on a particular investment so. There are two main reasons why net profit margin is useful. Shopifys free profit margin calculator does it for you but you can also use the following formula.

But when the product is sold at selling price lesser than the cost price it is termed as loss. For calculating the percentage of marks secured by a student in an exam you can divide the total marks secured by the student in all subjects by the maximum marks and then multiply it by 100. Z X Net sales Gross profit margin.

In other words given a price of 500 and a cost of 400 we want to return a profit margin of 20. P P. Using the Profit Percentage Formula Profit Percentage ProfitCost Price 100.

After covering the cost of goods sold the remaining money is used to service other operating expenses like sellingcommission expenses general and administrative expenses Administrative Expenses Administrative expenses are indirect costs incurred by a business that are not directly related. To calculate the profit percentage you will need the below-mentioned formula. Therefore Loss Cost Price Selling Price.

Gross Profit Margin Formula. How to calculate the percentage of marks. Profit margin percent can be calculated using the above method.

The prices of A B and C are Rs. Substituting the values we get the profit percentage as. A vendor purchased a book for 100 and sold it for.

Calculate the cost price of the table. The result of its profit formula is. Example of the Profit Calculation.

If he sold it for 65000 find his gross profit. Now to calculate the profit percentage the formula of profit percentage is as follows. Finally the formula for profit can be derived by subtracting the total expenses step 2 from the total revenue step 1 as shown below.

A business generates 500000 of sales and incurs 492000 of expenses. Profit margin is calculated with selling price or revenue taken as base times 100. Hope you understood how to calculate the Percentage margin profit of a set of values.

Copy the formula in the remaining cells to get the percentage change of profit margin for the rest of the data. Now using the gross profit Formula. Then divide this figure by net sales to calculate the gross profit margin in a percentage.

Gross Profit Margin Example. Profit Percentage Margin Net Profit SP CPSelling Price SP X 100. Example Using Gross Profit Formula.

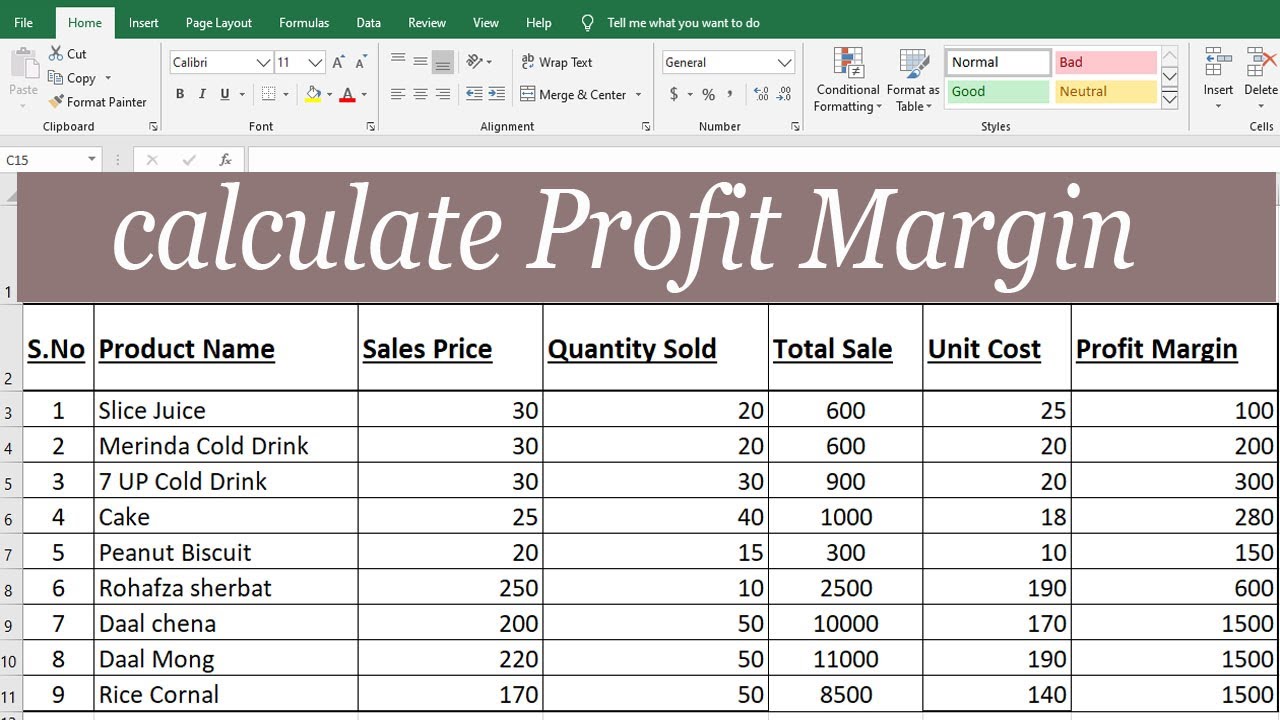

Ie 20 means the firm has generated a. Cost of goods sold 60000. In this example the goal is to calculate and display profit margin as a percentage for each of the items shown in the table.

Percentage formula is used to find the amount or share of something in terms of 100. It measures the ability of the firm to convert sales into profits. Each item in the table has different price and cost so the profit varies across items.

Profit percentage 025 100. Using the above formula Company XYZs net profit margin would be 30000 100000 30. Therefore the profit earned in the deal is of 5 and the profit percentage is 20.

It is defined as a number represented as a fraction of 100. Net sales are equal to total gross sales less returns inwards and discount allowed. Profit percentage is a top-level and the most common tool to measure the profitability of a business.

On selling a table for 840 a trader makes a profit of 130. A seller purchases a car at 60000. The percentage of discount given by the company A is twice the discount percentage given by company B.

To express a number between zero and one percentage formula is used. It is denoted by the symbol and is majorly used to compare and find out ratios. Relevance and Use of Profit Percentage Formula.

Profit percentage 25. The formula of gross profit margin or percentage is given below. Company Cs profit is 10 times its percentage of discount.

ABC is currently achieving a 65 percent gross profit in her furniture business. Profit Percentage fracProfittextCost Price x 100. Gross profit is equal to net sales minus cost of goods sold.

Gross Profit 5000. The basic components of the formula of gross profit ratio GP ratio are gross profit and net sales. Percentage Change changeinitial value x 100 Q5.

Profit Percentage Markup Net Profit SP. 3000 And Rs 2500 respectively. The formula should divide the profit by the amount of the sale or C2A2100 to produce a percentage.

Again the formula for profit per unit can be derived by deducting the cost price of production from the selling price of each unit as shown below. Profit percentage 25 100 100. Sales - Expenses Sales Profit formula.

More simply the net profit margin turns the net profit or bottom line into a percentage. Why Net Profit Margin Is Important. Here is the formula for Percentage change.

Gross profit margin which is a percentage is calculated by dividing gross profit by revenue. Net Profit Margin Formula. Profit Total Sales Total Expense.

As you can see in the above snapshot first data percentage of profit margin is 8. In its simplest form percent means per hundred. In the example the formula would calculate 1725 100 to produce 68 percent profit margin.

Profit And Loss Formulas By Bhumika Agrawal Studying Math Maths Formula Book Basic Math Skills

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Loss Rs Aggarwa Maths Solutions Math Methods Math Formula Chart

Excel Formula Get Profit Margin Percentage Excel Formula Excel Tutorials Start Up Business

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a Http Www Aplustopper Com Profit Loss Rs Aggarwa Maths Solutions Math Methods Math Formula Chart

Excel Formula To Add Percentage Markup Excel Formula Excel Microsoft Excel

I Found This Formulae Very Helpful It Shoes Four Different Ways Of Calculating Degree Of Operating Leverage Also It Breaks Down Contribution Margin Sales Var

Gross Profit Percentage Meaning Example Advantages And More Accounting Education Economics Lessons Learn Accounting

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Accounting And Finance Finance Investing

Gross Profit Vs Net Profit Definitions Formulas Examples Net Profit Accounting Training Profit

Profit And Loss Basics And Methods Examples Math Tricks

Manager S Commission Expense Double Entry Bookkeeping Management Bookkeeping Double Entry

Pricing Formula Startup Business Plan Small Business Plan Bookkeeping Business

How Do You Find Percentage Profit Or Loss Maths Formula Book Math Formulas Find Percentage

Profit And Loss Basics And Methods Examples Math Tricks

Pin By Vpuzzles On Finance And Insurance Math Questions Formula Math

Profit And Loss Rs Aggarwal Class 8 Maths Solutions Ex 10a

Calculate Profit Margin With Percentage In Excel By Learning Center In U Excel Tutorials Learning Centers Excel